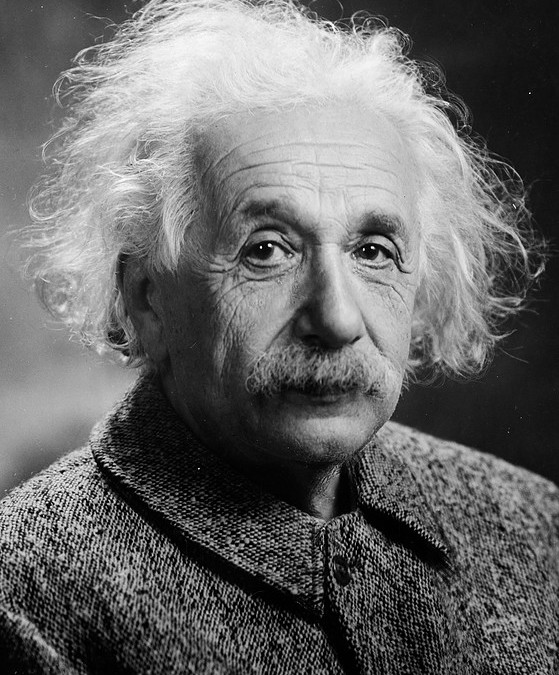

Albert Einstein authored the definition of Insanity: “doing the same thing over and over and expecting different results”. This is so true in the world of healthcare plans, that it drives me nuts.

Insanity can come from 2 sources: the broker and/or the employer. In most cases, the employer simply follows what the broker recommends, which in many cases – is clearly insanity because the broker doesn’t know any different – yet they keep doing the same things over and over.

This usually starts when a group gets a less than desirable rate increase at renewal, or the service from the insurance company or administrator is so bad that alternatives need to be explored. Most brokers don’t really get into the root cause of an unfavorable renewal increase, as they may see it as being the edict of an underwriter with little or no room to negotiate. So now the insanity begins.

Insanity can generally take two different, but consistent forms – either change the vendor (insurance company, TPA, stop loss, etc.) or change the plan of benefits by cost shifting to employees through higher deductibles, copays, out of pocket exposures, etc. Granted, sometimes these changes are necessary to be competitive and consistent in the marketplace; or if service becomes an issue, or there are network changes, etc., but the frequency of change in stop loss carriers or the change from one insurance company to another each year is incredible – just ask an underwriter how busy they are 3 months prior to a group’s renewal, predominately calendar year renewals. Roughly 70% of all health plans renew on a calendar year basis in the U.S., so the 4th quarter of the year is total chaos for insurance company underwriters and related vendors, because of brokers wanting to seek insurance product alternatives.

Changing these vendors typically occurs due to price increases. The broker perspective that is communicated to the employer is “let’s go find something cheaper”. While premium increases occur with regularity and are many times are unacceptable and change may be needed, alternatively the broker needs to ‘look under the hood’ to determine and understand the root cause of the problems and make recommendations for their corrections – not simply move business from one carrier to another and expect different results!

The second form of insanity comes from changing the actual plan of benefits. The thought is that cost shifting benefits to employees will somehow lead to lower, long term healthcare costs. While increasing the deductibles, copays, and out of pocket limits may initially lower premiums, it’s a short term solution to a long term problem. It doesn’t lower the cost of healthcare – it simply shifts the cost to employees.

While one could argue the benefits of High Deductible Health Plans create a more consumeristic and educational approach to the use of our healthcare system, I could also argue that they create a habit of neglecting needed services, screenings, prescriptions, etc. due to the greater expense that has been shifted to the employees.

Cost shifting to employees does lower the healthcare spend to the employer – everyone knows that – either through lower premiums, higher employee contributions, or perhaps immediate or short term claim costs. However, this doesn’t solve the real long term problem of increasing healthcare costs.

In order to avoid the “Insanity” in healthcare, one must look into the root causes of the group’s healthcare expense. Is it because of chronic conditions? High cost claims that are acute? High facility costs? Expensive drugs? Data is key (the right data) to this investigation – and having someone who can interpret the data and recommend innovative, effective, and proven solutions is critical.

With regard to the healthcare benefits you provide to employees, it’s not about price – it’s about cost! There is a difference.

Unfortunately the brokerage business is one which is over promised and under delivered. You don’t know what you don’t know.