Introduction and Background

Several years ago I published a White Paper, and one of the observations noted at that time was a relative lack of ‘buyer sophistication in the marketplace. Knowledge of health plan alternatives other than those offered and packaged by the major insurance companies was not readily apparent. Consumer Driven Health Plans such as HSAs and HRAs were not widely utilized at the time. Wellness and Health Risk Management programs, if evident, were only scratching the surface of effectiveness. Partially self funded plans were being utilized by only some larger employers but not necessarily prevalent. Also, a thorough understanding of the in-depth capabilities of related vendors such as TPAs, PBMs, stop loss, etc., was lacking. The focus was on the “transactional” side of the equation rather than the actual “cause and effect” side of the healthcare equation, and what could be done to actually improve results.

Current Broker Environment

The lack of buyer sophistication can be attributable in large part to the lack of broker sophistication, knowledge, and expertise in the local, regional, and national marketplace. In order to understand why there isn’t more broker expertise, one must understand the general nature of brokers in the marketplace. Many brokers are motivated by incentive compensation received from various insurance companies that they write business with. Insurance companies compensate brokers with commissions not only on each client account, but also pay incentive overrides based upon the amount of business, or block of business that is placed with each insurance company.

Therefore, brokers are not necessarily motivated to seek alternative programs because they would not get paid as much by the insurance company than they would otherwise get paid for a larger and larger book of business. In fact when you think about it, who actually benefits financially from lowering the the cost of healthcare? Hospitals? Insurance companies? Brokers? Pharmacy companies?

Many brokers also rely on an insurance company to provide many additional services such as legal compliance, communication, and wellness programs, so most independent brokers do not have the depth and breadth of resources to provide these services directly to their clients. If they do have resources, then they are generally very limited, or even outsourced.

Many employers try their best to evaluate a broker through a Request For Proposal (RFP). A RFP can be a good way to begin the process, but in most cases does not begin to be deep enough into the differences between brokers by asking the most appropriate and important questions.

The vast majority of employers have identified the continued escalation of healthcare costs as one of the most significant issues that they face in today’s economy. Health plans cannot continue to absorb annual cost increases of 5-15%, or more, for their healthcare premiums. Passing costs on to the members through higher cost sharing, minimizing cost increases through plan design modification, or leveraging a better rate by changing carriers are merely short term fixes. These strategies have run their course over the last couple of decades, and most health plans are now looking to education, consumerism (empowering employees to become wise health care consumers) and health risk management to stabilize corporate health care costs.

Does the “transactional broker” model address the primary drivers of healthcare costs?

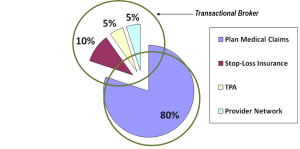

The inherent challenge is that most brokers are merely “transactional” in nature – they are not providing any innovative solutions to their clients in an attempt to control health care costs other than a promise of being “creative” and “aggressive” during the annual renewal and negotiation process. The reality is that a transactional broker can only impact approximately 20% of an employer’s total health care spend. As illustrated in the chart below, this 20% consists of fixed costs such as reinsurance, pharmacy, network and administrative expenses. What factors account for 80% of the cost for healthcare? The actual claims and utilization.

The Solution? An Integrated Approach to Managing Benefits and Health Management

Over the last few years, research has uniformly demonstrated that an organization’s healthcare costs can be impacted dramatically with a professionally designed and implemented Health Risk Management program to not only enhance the services provided to employers and employees, but to essentially transform how to assist employers control their organizational healthcare costs.

Employers have investigated ways to implement a wide variety of strategic approaches, from the very basic to the most integrated. The challenge is not only to identify improvement opportunities for health and productivity, but also to provide integrated health and benefit strategy consultation, implementation and program support. From the most basic health risk management activities to the most sophisticated approaches, your broker should assist in getting you from where your organization is, to where you want to go.

Unfortunately brokers can over-promise and under-deliver. You may know what your broker is doing for you; you don’t know what they are not doing. Satisfaction of a broker doesn’t necessarily mean that the broker is delivering the services that you should necessarily expect. Services should go beyond that. It is absolutely necessary to do a deep dive into the evaluation process so that distinctive differentiation can be understood.