I recently attended a webinar about the impact of COVID-19 on fully insured plans. It was very interesting and eye-opening about how much money is going to insurance companies from employers with fully insured health plans, versus what an employer could save being partially self-funded.

As we all know “flattening the curve” was intended to keep our hospitals from being overrun with patients who had significant effects from the virus. By isolating ourselves and significantly reducing interaction amongst each other – we flattened the curve. Very few hospitals in this country were overrun by actual cases. It’s just the opposite of what everyone predicted.

In fact, what has actually occurred by isolating and flattening the curve is that many people postponed or eliminated elective surgeries and non-essential procedures, diagnostic testing, and routine medical care. As a result, there has been a significant reduction in hospital revenue due to the reduction in care, and now because hospitals aren’t nearly at capacity, there have been fairly large layoffs and furloughs of hospital employees to cut expenses.

So now let’s get to some numbers – stay with me here. Dr. Erik Bricker CMO at HealthcareZ illustrated what is happening with fully insured plans, and asked the question “where is all the money?” For those employers who have fully insured plans, they are still paying premiums to their insurance company, yet due to the reduction of procedures and testing, insurance companies are having are not having to pay as much out in claims. Some estimates are as much is 30% less.

Consider this: 157 million Americans are covered by commercial insurance – 39% are in fully insured group plans, or 61 million Americans. This translates to about 30.5 million employees covered. Of these, statistics show that 52% have single coverage, 18% have single +1 coverage, and 30% have family coverage. According to Kaiser, here are the average national premiums for each of these coverages:

Single Single + 1 Family

$7,188 $14,375 $20,576

If we break down the 30.5 million employees into the percentages of 52%, 18%, and 30% respectively, this equates employee lives to:

16 Million 5.5 Million 9.1 Million

Further, if we now multiply the premiums times the number of employees covered then the insurance companies are collecting:

$15 Billion $79 Billion $187 Billion

For a total of $381Billion!! Insurance companies are collecting a third of a Trillion Dollars!!

If the Medical Loss Ratio was 80% that means of the $381B that they collect from fully insured plans, they would expect to pay out $305B in claims and retain $76B as the cost of doing business. However, if claims are 30% less that would only amount to $213B ($305B X 70%) to pay out in claims or a 56% Medical Loss Ratio (illegal). If they collected less in premium to have an 80% loss ratio then they would only have to collect $266B in premium not $381B. This means that by collecting the $381B in premium, they are holding onto $115 billion per year than needed or $9.5 billion a month!

Employers fully insured premiums are not being reduced by 30% yet the insurance companies are paying out 30% less and keeping the rest. Why give all this money to the insurance companies every year? Kind of makes you want to buy stock in the BUCAs (Blue Cross, United, Cigna, Aetna) doesn’t it?

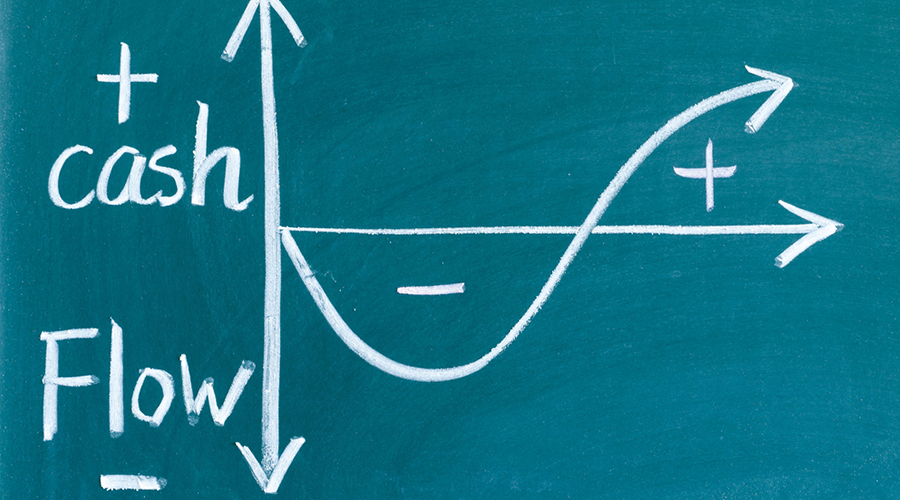

61% of employers in this country have (partially) self-funded plans for this very reason. They want control over their health plan rather than relinquishing it to an insurance company. This gives them a significant advantage over employers that have fully insured plans due to the impact on their cash flow. There are many other advantages and protections as well.

I’ve been working in the self-funded arena my entire career helping employers significantly reduce the cost of their health plan. If you would like to learn more about partially self-funded health plans and what savings you can expect compared to what you’re currently paying, you can reach me at [email protected] or call me at 970 – 349 – 7707.