What is the highest expense on your P&L? For most companies it’s wages and payroll.

What’s the second or third highest expense on your P&L? For most companies it’s health insurance.

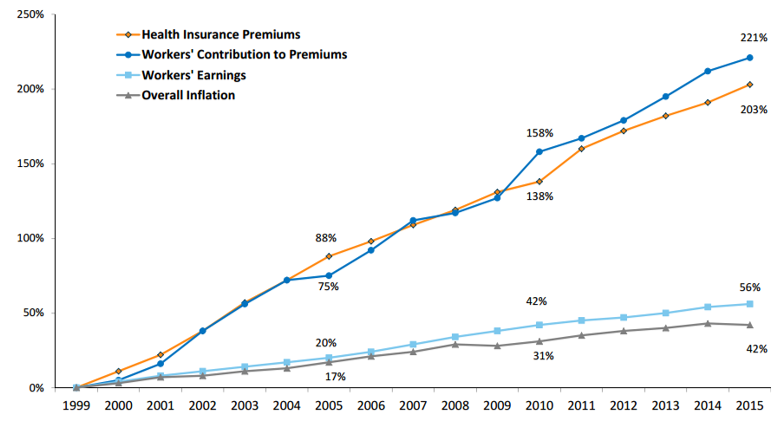

The problem is that the highest expense is not increasing as fast as the second or third highest expense. Historically, wage increases have been in the 0 to 3% per year range, and health insurance has been rising 8%, 10%, or 15% or more per year. How is an employee supposed to keep up with the increasing cost of health insurance either through their weekly paycheck contributions, or when they occur a claim? Couple that with a dramatic rise in high deductible health plans to offset the rapid increase in premiums, it’s also hard for employees and their family members to pay for services when rendered.

Good human capital is very hard to find. Employees are certainly valuable to your operation. Do you think you could attract and retain more valuable employees if you could pay them more and afford the health insurance too?

What if you could take your second or third highest expense on your P&L (health insurance) and drop it by 30%? Would you reinvest back in your company? Would you pay your employees more so you could attract and retain quality people? What would you do?

Employers struggle with this balancing act every year – how to give employees meaningful wage increases and maintain a competitive health plan at an affordable cost. The 2017 Kaiser Family Foundation Health Benefits Survey showed that for All Plans the health insurance costs for Single coverage rose to an average of $6,690 per year and $18,764 per year for family coverage. And it didn’t go down in 2018 – it only goes up every year.

In 2015 Kaiser, Met Life, and the National Business Group On Health conducted surveys and the Number 1 concern of employees was their ability to afford health care – either out of their paycheck each week, or when they incur a claim.

Consider this:

“Medical Bills Are the Biggest Cause of US Bankruptcies”

- ETCNBC.com, June of 2013

“over half of all items on credit reports are medical debts”

- Press Release, March of 2015, by the New York Attorney General

“42.9 million people have unpaid medical debts, according to a new report by the Consumer Financial Protection Bureau”

- December 2014 Report by the Consumer Financial Protection Bureau

- This is 1 of every 8 Americans

Is your company facing similar challenges every year? Are you simply “cost shifting” increases to employees every year to make the insurance more affordable? How often have you heard something like this from your insurance company or broker – “I have good news and bad news. The bad news is that your health insurance rates went up by 17%, but the good news is that we went to work on the insurance company and they reduced the increase to only 12%!” Good grief!!

I’ll repeat one of my questions earlier: What if you could take your second or third highest expense on your P&L (health insurance) and drop it by 30%? It can be done without compromising your benefit program! Might even make it better!

Call me at 970.349.7707 or email me at [email protected] and we can chat.