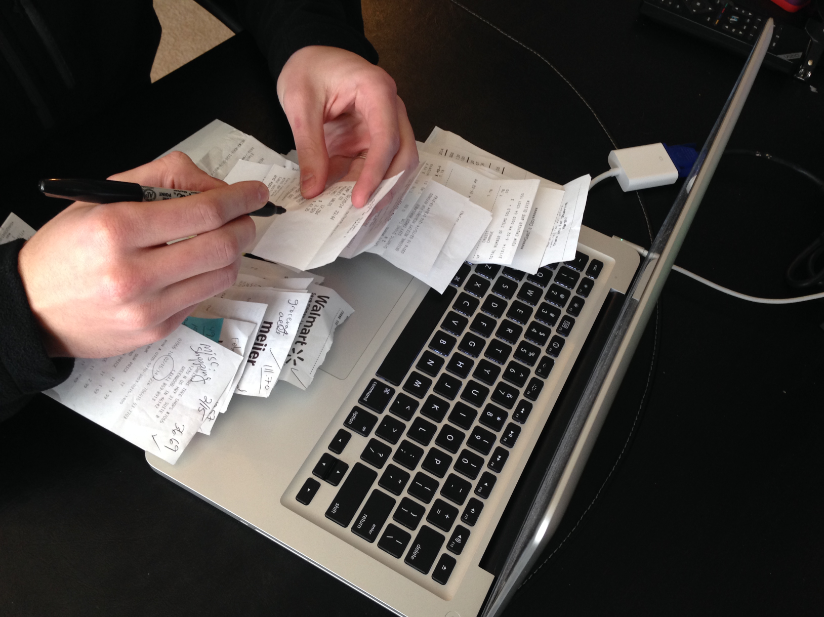

Travel and business receipts are very important documentation for business expenses incurred by employees. It includes everything from meals, business entertainment, auto expenses, dues and subscriptions, and a host of other items.

Every CFO or financial person for business keeps a close eye on those receipts for tax purposes. It doesn’t matter whether it’s a $10 travel meal, a client lunch, or a big seminar expense. The actual receipt for documentation is essential.

I have been in situations where I have had to pay for the travel or business expense, keep the receipts and fill out an Expense Report for the month. Alternatively, I’ve been given a corporate credit card for those expenses, but still needed to keep the receipts for my Expense Report.

I can remember instances in the past where I had lost or misplaced a receipt and my manager wouldn’t approve the expense because I didn’t have the receipt – it didn’t matter what the amount was, they just wouldn’t approve the expense to be reimbursed.

I get it. I understand the importance of documentation of all business related expenses. But doesn’t it seem odd that the CFO, controller, or department manager would pay more attention to a $50 receipt for a business expense, but not a medical bill that would be tens or hundreds of thousands of dollars or more?

Yet, this is the way we all handle medical bills within our company’s health insurance. While these costs are also a deductible business expense, we don’t pay close attention to the itemization within those bills. The bills from a provider get sent to the insurance company for adjudication and payment – we see what we owe on the Explanation Of Benefits (EOB). That’s pretty much what everybody pays attention to – not the charges.

Hospitals use a Universal Billing form called a UB04 (formerly UB92) to bill services rendered at a facility. This is a summary bill which includes summary line items such as hospital room and board, operating room, medications, miscellaneous charges, etc. There is no detail or itemization on a UB. The UB is then sent to the insurance company whereby allowable charges are determined based on the actual health plan, PPO discounts are applied, employees deductible and out-of-pocket are determined, and the hospital is then paid difference.

Where is the accountability to detail for a hospital bill to be reviewed by a CFO, controller, or department manager, that would otherwise be scrutinized for travel and business expenses? And, we are talking about medical expenses that are astronomically higher than travel and business expenses. Why don’t we demand more detail and scrutiny of the charges from a hospital or other medical provider?

The basic answer: we don’t really care. We just assume that everything on the bill is accurate and take for granted the charges. And oh by the way, many simply think that the insurance company is going to pay the bill, when in fact the employer is paying for it through either fully insured premiums or self-funded claims.

In the big scheme of things doesn’t it seem really odd that we’re paying attention to pennies while letting big dollars fly out the window. So I would challenge businesses to secure services to audit medical bills just as they do travel and business expenses. There are programs out there that can do just that – audit medical bills. You wouldn’t believe savings.

If you’d like to learn more about the availability of audits on your medical bills for your employees and their family members and the impact on your bottom line, you can reach me at 970 – 349 – 7707 or email me at [email protected]