It’s interesting to understand the relationship that insurance companies and their respective PPO networks or provider networks have with brokers, and what brokers tend to admit that they know. Insurance companies are notorious for touting that their network is the largest, with the greatest number of providers, and the best discounts on the planet. Every network seems to tout the same thing.

Most brokers tend to acknowledge and agree with this. This is because most brokers don’t have the ability to delve into the detail to question the statements or understand which PPO network is in fact the best. The contracts that providers (hospitals, facilities, and physicians, etc.) have with the PPO networks are confidential. This means that the PPO cannot divulge or substantiate their remarks that they have the best discounts. Brokers will just take them for their word.

To illustrate the point, a hospital has what is called a charge master – this is a voluminous file of all services that they render to a patient when they walk in the door and all related prices. It includes everything from Band-Aids and Ibuprofen, to minutes in the operating room, to the intensive care unit, and everything in between. As you can imagine it is substantial. These are the billed charges that all PPO discounts relate to. So when a network negotiates with a particular hospital, then the discounts that they’ve negotiated are applied to those billed charges.

For example, a 20% discount would be the discount off the billed charges. The problem is that there are no regulations, rules, laws that could prevent the hospital from increasing their prices in the charge master. It’s much like the discount that you receive at a retail clothing store when a big sale goes on. They advertise the big discount, but the store marks up the price of the clothing from what it was prior to the sale so in reality, a bigger discount doesn’t necessarily mean a lower price. An exception to this would be where a network has negotiated a case rate on specific procedures, or a rate based on a percentage of Medicare. With most PPO networks, the Medicare plus rate only extends to charges that are below a specific threshold, for example $80,000 or $100,000. Anything in excess of that reverts back to a discount off the bill charges. But those are the charges that you want a better Medicare plus rate – not the smaller ones. Clearly the facility wants only a discount across the board.

Physicians on the other hand are slightly different, yet similar. Physicians may operate and negotiate independently, or as a group of physicians, or as an association per se. There are many models associated with this for establishing pricing with the PPO, but usually it’s a matter of two different types of pricing at the end of the day. One may be a discount off of Reasonable and Customary charges (UCR), and another might be on a Resource-Based Relative Value Scale “RBRVS”. This is very similar to the Medicare plus arrangement for a hospital or facility. RBRVS is tied to Medicare and generally speaking the provider would get a percentage above Medicare e.g. 165%, 180%, 200%, etc.

Depending upon the geographic location of the providers, the number of members that an insurance company or PPO network can deliver to the providers, and other factors will dictate which methods are used. The more members that can be driven to the network providers usually correlates to a more aggressive pricing structure.

Brokers will tend to believe the insurance companies or networks as to who has the best discounts. At the end of the day, the broker needs to have access to mechanisms that will substantiate those pricing structures or not. If the broker doesn’t have access, then an employer and the broker are simply taking a leap of faith and trusting that the insurance company or that the network is truthful. Sometimes, when a broker asks for claims to be repriced-which is a pretty good way of looking at alternative networks-a network may trick the broker by illustrating their best rate at their best facility, rather than citing actual pricing at the actual facility, for the actual services provided. There are tricks to the trade where a network can hide the real cost or pricing that they have negotiated. You might find an insurance company that touts the highest discounts (which may be partially true) and the best pricing at hospital, but may lose the total advantage of their network because they may not have favorable pricing with the physicians. Or vice versa. So while they may be better with a particular local hospital than their competitors, they would lose that overall advantage and overall pricing because they weren’t as competitive with the physicians.

Brokers need to understand these pricing methodologies and develop strategies for more aggressive direct contracting. Direct contracting will enable a self-funded employer to negotiate its own pricing with the more important providers in their area that treat most of their employees and other family members. Many providers are open to direct contracting if the employer’s health plan can incentivize employees through better benefits to go to those providers rather than other network facilities.

For example, a direct contracted providers plan might pay 80% coinsurance after the deductible, other PPO network providers paid at 70%, and non-network paid 50%, or some semblance to this. Incentives are easy to design, but care has to be given to designing the plan so that the employer potentially is on the right end of the stick. This means that if an employer is going to give an additional 10% incentive to employees to go to a particular hospital, then the additional discount over and above the traditional PPO network discount needs to be more than 10%. Otherwise it’s a lose/win situation.

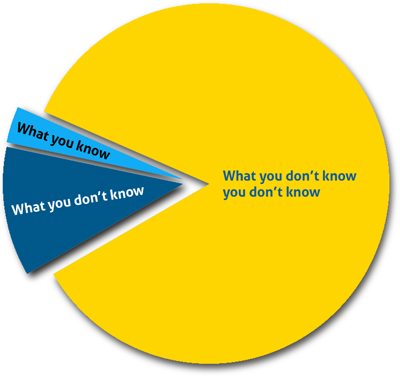

If brokers don’t have the ability or desire to negotiate on behalf of their clients, then their clients are pretty much stuck with the PPO discounts through the network. You don’t know what you don’t know. You think you’re getting the best discounts? Really the best discounts? How do you know?

Stop loss carriers may or may not have the ability to evaluate networks. And they need to be made aware of direct contracting that exists and the pricing. They can then price their specific stop loss deductible premiums and their aggregate attachment points at the appropriate levels. Some stop loss carriers are better than others at evaluating this.

One of the big areas that knowledgeable stop loss carriers and underwriters will give the greatest credence to is Reference Based Pricing-but it has to be at a very competitive level. If Reference Based Pricing is available for facilities as well as physicians, this is the best of both worlds. Many brokers fail to explain the pricing of the network to the stop loss carrier thinking that it doesn’t matter, or that every carrier can give the same relative discount in their quote. Once a particular stop loss carrier has experience with the carved out providers, and the direct contract network, then they will be more apt to provide aggressive pricing. Results are extremely important to share with an underwriter in order to get the best pricing. And stop loss carriers can tell you which networks not to use or which ones they don’t lend any credence to.