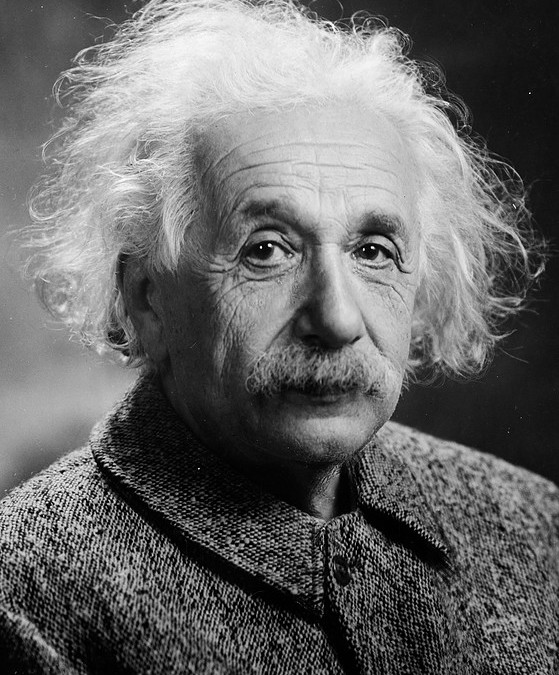

Do you remember the Rule Of 72? I wrote an article about a year ago about the Rule Of 72 and it’s effect on the rapidly rising costs of health plans. If you don’t recall the Rule, it’s the law of compounding interest. Einstein called it the Ninth Wonder of the World. If you take a specific interest rate and divide it into the number 72, the results is the number of years that it takes money to double. If you use you rate of increase in your health care costs and divide it into 72, the result is the number of years it takes for your costs to double.

I am truly amazed at the rate of increase that employers accept every year from their insurance company, reinsurer, or in medical and pharmacy claim costs – 7%, 12%, 16% or more. They initially get a big increase and get sticker shock; their broker or consultant “goes to work” to lower the increase; and the result is still a pretty big increase but lower than the initial one – and the employer actually feels good about it.

Case in point, I recently spoke to an employer who received a 18% and they told their broker that they couldn’t accept it, that they would have to look at alternatives – either a different plan of benefits (cost shift to employees), a different insurance company, a different financing method, or a different broker – or all of the above. Their broker subsequently came back with a 12% increase, and not only did the employer feel better – they accepted it.

The lack of understanding the Rule Of 72 puts your entire health plan at risk. Using a 12% increase as an example, the cost of this employer’s health plan will double in 6 years. Every year employers hope that they will have a better year “next year” with lower costs, but the reality is that unless employers understand and accept proven alternatives to lower costs, it’s only a matter of luck and/or time before costs double.

To make your health plan sustainable for the future does require change (not the types of change mentioned above). It does require a bit of courage. You must change from the traditional PPO pricing methodology, and have the courage to take the steps necessary with employees. If everyone wants their health care plans to continue to exist, everyone must take responsibility and change the paradigm.

An employer has no clue about what their PPO Network has negotiated in pricing with medical providers and never will – it’s proprietary. And, employers do not have the contractual authority to audit claims for errors, as it relates to that pricing. Thus, we all continue to pay for services blindly – we agree to pay whatever we’re told without knowing what the prices are before the services are rendered!

Employers can’t be afraid of employee angst due to a change in provider pricing methodologies. Make employees part of the solution. Reward them for helping to lower employer costs as well as their own costs. Educate and communicate them and have them challenge the status quo. Would they rather pay $1,000 for a CAT scan or $200? They need to understand how this can be accomplished and what they must do.

Don’t let the Rule Of 72 double your costs in a few short years. Take the necessary steps to not only lower the increase in costs, but lower the actual costs from year to year. How much longer can you afford your plan? Sometimes you don’t know what you don’t know.